Elon Musk

I generally discuss the charts of impressive companies. But today I am going to describe the chart of the most influential person of decades. I want to see if we can explain his life from his birtth chart.

Elon Musk was born on 6/28/1971 in Pretoria, South Africa. He is an innovator and business magnate and can realize the unthinkable. His achievements are extraordinary, the best being the use of electricity for automobiles. Can we see such a person in his birth chart? Let us see.

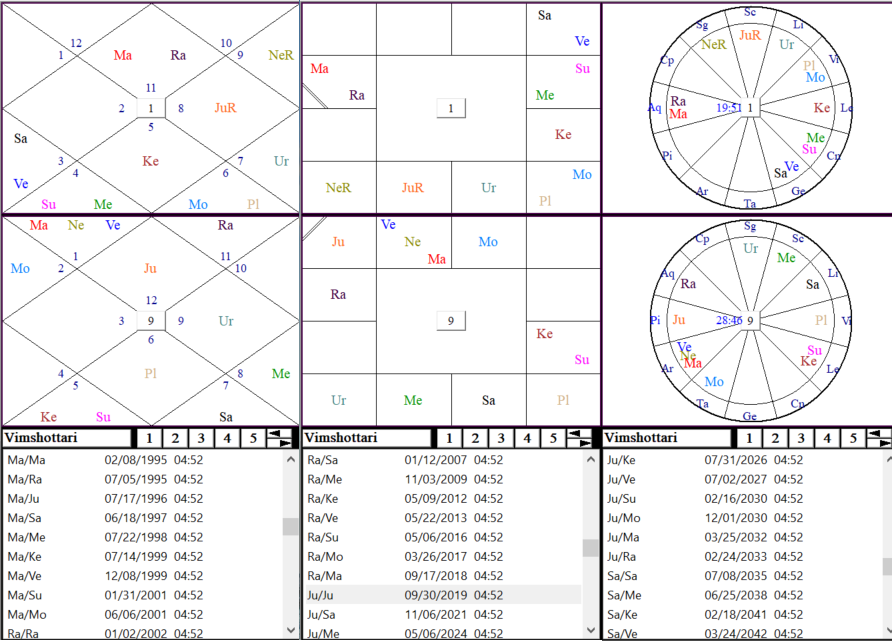

Here is his birth chart.

The ascendant is Aquarius, a sign of innovation. Mars, a planet of action and energy, occupies the ascendant. Rahu also occupies the first house. Aquarius is Rahu’s Moola-trikona sign. A strong Rahu in the first house gives enormous courage and enthusiasm and makes a person dare the devil. He alone can muster the courage and guts to fight the mightiest of the world.

Mars, the planet of energy, makes a grand trine with the love planet, Venus, in Gemini and the science planet, Uranus, in Libra. Both Gemini and Libra are the signs of innovation. Most of the planets are in the air signs. Putting all the things together easily explains the innovative and scientific level of Elon Musk.

The wealth planet Jupiter rules the two houses of money, the second and eleventh. It occupies the most prominent house of the chart, tenth. Retrogradation makes it even more beneficial. He started the major period of Jupiter in 2019. He was already highly wealthy before this period started.

Now, let us look at the Navamsha, which shows the real strength of the chart. Mars and Sun occupy their Moola-Trikona signs, Jupiter its own sign, and Saturn and Moon their signs of exaltation. Rahu and Ketu in Vargattama. I have studied thousands of charts, but I have never seen such a powerful Navmsha chart. No wonder he is a man of his own caliber, unparalleled in the present day and age.

February 2022

My view about the month December 18 – January 16 was that it would be a down month for S&P 500. But it ended flat. Although the indexes were flat, a lot of leading stocks fell hard. The list included NFLX, SHOP, TSLA, AAPL, and ADBE. Next month (January 17 – February 14) was difficult. I believe I was only one month earlier to predict the coming correction in the stocks. Anyway, more stocks fell during this month. This time it was the turn of FB, PYPL, UBER, etc.

Now the question is will these stocks recover? If yes, when will these stocks recover? I generally use the transit of Jupiter over the natal chart to see the price movement. Based on that, I believe the period of May to October when Jupiter comes into Aries will be good for TSLA and FB. TSLA can even try to target new highs, whereas FB will also try but not succeed. Other stocks may have to wait longer.

Please note these are my views based on astrology. I had been wrong earlier many times and maybe wrong this time also.

September 2021

Here is a relevant question from a Viewer that other viewers might have too. I thought others may like to know answer too.

Hi Raj

Could you explain something to me (and perhaps to all your subscribers?) something vexing…

On your web page, you marked Sept 19 – Oct 18 as bearish but for the monthly bitcoin forecast, you’re apparently using another calendar system (standard) where you marked September 2021 as bullish. Do these two dissimilar months half-overlap? Or is “September 2021” just a shorthand for “Sept 19 – Oct 18”?

Should I expect the S&P 500 to pull back during the second of half of September while bitcoin continues to rally?

The basis of the monthly solar return chart is the NYSE chart, and for bitcoin is the bitcoin-genesis chart.

Using those charts I expect the month Sept 19 – Oct 18 could be bad, whereas the month of Sept 5-Oct 4 (using exact dates now instead of rounding up as September) could be good. It does not mean every day within these dates would be good or bad. So the answer to your question cannot be “yes”, but only “I don’t know”. However, it could be “yes” also if the money moves out of stocks into cryptos.

Notable Stocks – April 2021

The astrological point of view on the stocks which are in the news currently performing are discussed here.

TSLA -Tesla Inc (Mar 28, 2021)

People are very concerned about this stock, as it has moved strongly higher in 2020, and now correcting in 2021. It is highly overpriced, and some people think it can crash. I am going to write my long term astrological viewpoint about this stock today. Investors should use their own diligence to invest in this stock.

The stock gave a stellar profermance last year because the period of a strong Jupiter in Aries had just started. This was combined with the transit of strong Mars in Aries, which lasted for 7 months due to retrograde motion. Such coincidences are rare. It started corrected as soon as Mars moved to Taurus. Since the stock is still under the major-period of Jupiter, one cannot say that the stock will crash or go significantly down over the remaining period of Jupiter. Jupiter period started on 2/28/2020 and would last until 2/27/2030. Good sub-periods would last until 2/27/2028. But for sure the kind of move it has seen in 2020 is not going to happen again, although it will still be a good stock to own.

The action of transits is significant when strong planets conjunct the Maha-dasha and Antar-dasha planet. So whenever Mars and Sun comes back to Aries, the upside moves may be seen. Note that Sun comes to Aries on March 21 and leaves on April 21, every year. The stock may therefore recover now during this period in 2021. It may also do better during this month every year. The months of Mars coming to Aries are June-July 2022, May-June 2024, April-May 2026, and March-April 2028. One can expect good performance during these months.

Combining the effect of dashas and transits, I think the stock will do good for years to come, but one cannot expect it to double every year now. Using astrology I can only see the direction, or good or bad period. I cannot put numbers, i.e. I cannot say how far the stock prices can go up.

Disclaimer: These are my conclusions based on my knowledge of astrology. I do not guarantee that it will happen like that. I may be entirely wrong also. Please keep that in your mind, and make your own decision on investing in TSLA stock.

TSLA -Tesla Inc (Jan 24, 2021)

After my last upate on Tesla, the stock has been going up, up and up. I had warned about shorting this stock, because I was seeing good planetary configurations only. I have decided to give my astrological views again on this stock. I think, TSLA price may go slighly higher or remain flat in February, flat in March, and lower in April 2021. Let us see how this monthly study works out. I will then update it again in April.

TSLA -Tesla Inc (August 2020)

The stock of Tesla has been performing as if there is no upside limit. It was $330 on March 18. Today, August 21, it is about $2100. That is more than 6x in five months. I therefore decided to look at it closely and share with you as to ‘how can this happen’ and see if it is a time to short this stock. Well, my findings may surprise you. The configuration of planet is still favorable for this stock until next year. I cannot say how far this can go, but if somebody wants to short it, he should be extra, extra careful.

An update about Mallinckrodt (MNK):

This company has filed bankruptcy last week. I have mentioed earlier also – in comments section – that this stock is a total gamble now. It can go to ZERO in a few months. And there is a high probability of that. It may also go to $5 or $10 or even $20 in about 5-10 years. But there is only a small probability of that. If you are invested in it, leave it there if you are completely OK with losing your money. Otherwise sell to recover at least $1.50.

Other companies of 10 for 2020 like, AMZN, FB, WIX, ENPH and BIIB etc are doing good. This episode only shows the importance of diversification.

_____________________________________________________________________________________________________________

I see you don’t monetize stockastrologer.com, don’t waste your traffic,

you can earn additional bucks every month with new monetization method.

This is the best adsense alternative for any type of

website (they approve all sites), for more details simply search in gooogle: murgrabia’s tools

If a trader decides to work with both charts, Meridian suggests that he shall focus on the shared areas. For example, IBM was incorporated when the Sun was in Aquarius, and it also started trading its shares when the Sun was under the same sign. Therefore, transits to IBM’s Sun (and to the sign of Aquarius in general) will be more powerful than usual. For example, as illustrated in Example 4 in the third edition, when Saturn entered Aquarius in 1991 and stayed there until 1994, the share price of IBM resulted in a slump.

Eden:

I have tested this model, but could not accept it, as it as failed in many cases.

Thanks anyway

Raj Chadha

How do you see DATA?

Andrew:

In my opinion DATA is doing good because Jupiter is transiting over natal Saturn. If market continues to do good, 2019 may even be better for DATA.

Good luck

Raj

Hi Raj,

Found your website recently, thanks for the valuable information you provided here. I wonder if you have a long term forecasting, like 2007 top and 2009 bottom. I know the basic knowledge of astrology (Western), due to Saturn square Uranus in 2020, Seems stock will be at trough that year. What is your advice?

Btw, my son will graduate from UCSD this month.

Best,

Beverly

Beverly:

Thank you for visiting my site and commenting.

As per my methods the period between June 2019 and May 2020, my be erratic. Let us see how things take shape.

Congratulations for your son. I taught chemistry there during 1988 to 1991.

Raj Chadha

Hi Raj,

Do you foresee any Minor OR major upheaval in stock market in near future. Is it risky to indulge in it in current state of affairs?

Tapan Vahia

Tapan:

I expect the first week of August to be difficult. Other than that I think the market may continue to move sideways or slightly higher.

Good luck

Raj Chadha

Hello Sir,

Would it be helpful for one to determine how a stock fits with their chart by judging the Nakshatra’s and ashtavarga score for the houses and planets that the trade chart is in? Thank you so much.

Susannah:

You can certainly try. I use ancient method of kutas coupled with western techniques of using aspects between the two charts.

Good luck

Raj Chadha

hello sir,

it would be gracious , if you could explain your concept of kutas and western chart with example charts… thank you very much

Reek:

I do not understand your quesion clearly. Still it seems to be a lot of work.

Raj Chadha

I am small investor resident in India.Thank you very much for extensive coverage on stocks research I m trying your principles for Indian stocks Are there Any hints for Indian stocks at present I would be very eager to know from you.

Mr. Notani:

My method should work for all stocks. I have no information about Indian stocks. I am an NRI for the last 38 years.

Thanks

Raj Chadha

Hi Raj

Thank you for your good work.

Can you help me check the astrology of Ncr and Armh

Thank you very much

Best wishes.

Amy

Amy:

I do not have a chart for NCR. ARMH is a British company. It started trading in USA on 4/17/1998.It is possible that it was trading in London before. I therefore would not do any analysis on ARMH.

Thanks

Raj

Dear Raj

Thank you and best wishes to you and family

Amy

Greetings, Dr. Raj

Just wanted to let you know that I appreciate very much all that you do. I recommended your site to a friend who is learning astrology as he finds financial astrology fascinating as well. Thank you for the new stock picks.

Elle

Thanks Elle, I appreciate that.

Raj

I enjoy your philosophy & goals & your attempt to educate.

I would love some comments on ETF’s , as I only invest in a few stocks.

I don’t suppose you could comment on broad ETF indexes?, or asset classes?

So many of us have become weary of individual stock investing.

I’m sure you know that.

Thank you.

George Cohen–Berkeley, CA

George:

Thanks for the nice comments. If you invests in ETF’s only, you can use the direction of the general market to make your decisions.

Good luck

Raj